A review by corporate watchdog ASIC has found that 90 per cent of the advice received by self-managed superannuation funds was in breach of the law and clients’ funds were at risk as a result.

It also found that many SMSFs had dangerously concentrated investment profiles and that many people who set them up didn’t understand their legal responsibilities as trustees or mistakenly thought they had legislative protections similar to pooled super funds.

The results came from several surveys by ASIC which covered 735 SMSF owners reviewed by the regulator and independent experts.

“Decisions about super are some of the most important a person can make. However, ASIC found there is a lack of basic knowledge of the legal obligations in setting up or running an SMSF,” said ASIC deputy chair, Peter Kell.

ASIC’s surveys found that accepting advice to set up an SMSF could seriously misfire. In 10 per cent of cases reviewed “the client risked being significantly worse off in retirement as a result of following the advice”, ASIC found.

In another 19 per cent of cases, “clients were at an increased risk of financial detriment due to a lack of diversification” and much of that diversification risk is a result of using SMSFs to feed our national property obsession.

ASIC found that 22 per cent of members set up funds to buy property between 2015 to 2017, up from 19 per cent from 2011 to 2014 and some “were using it solely for this purpose without a wider investment strategy”.

“It is also concerning many people with an SMSF have not understood the importance of diversification, which puts their financial future at risk,” Mr Kell said.

That property focus puts them at risk from “one stop shop” property spruikers where advisers have conflicted relationships with developers or agents. That can lead to “poor advice that did not take account of their personal circumstances or is not given in their best interests”, ASIC found.

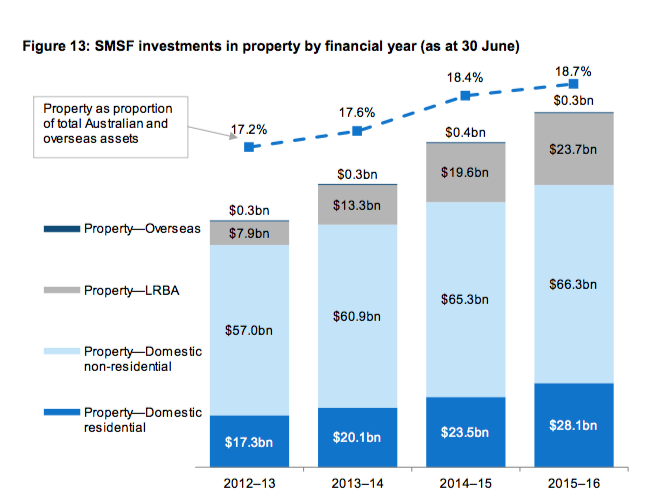

SMSF property asset exposure has stayed relatively stable, with property accounting for 18.7 per cent of total assets in 2016 compared with 17.2 per cent in 2013. However, there is a noticeable shift to leveraged deals with risky debt funded investments.

These limited recourse borrowing arrangements [LRBAs] are up from $7.9 billion, or 9.5 per cent of SMSF assets, in mid 2013 to $23.7 billion, or 20 per cent, in June 2016.

ASIC also found that poor record keeping resulted in non-compliance and that some SMSF owners didn’t understand that they were required to have a declared investment strategy and keep to it. Many people appeared to be setting up funds on the advice of professionals without understanding their legal requirements.

‘”It is clear lots of people are setting up self-managed super funds without knowing whether this is the best option. The financial advice sector has significant work to do to lift their performance on this issue,” Mr Kell said.

ASIC said it would crack down by “taking follow-up regulatory action, in particular where consumers have suffered detriment”.

Dante De Gori, CEO of the Financial Planning Association of Australia, said: “It is disappointing to see such a large number of SMSFs are not complying with legislation. One stop property operations are really a big problem and people need to get advice that takes into account their complete personal situation.

“The full force of the law should be applied to make sure the industry is compliant,” he said.

John Moroney, CEO of the SMSF Association, said: “Advisers speaking to consumers about SMSFs should have specific SMSF education and qualifications underpinning their advice.”